The Government has enabled the option of payment through credit card, UPI, and internet banking on the income tax e-filing portal. However, if an individual opts for payment of income tax on the e-filing portal for the 'payment gateway' method, he may be charged certain charges if he opts for such a payment method.

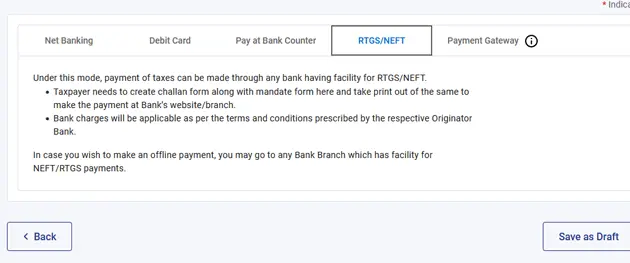

In addition to internet banking, the e-filing tax portal enables an individual to pay income tax using NEFT, RTGS, and over the counter (physically at a bank branch).

The next time you pay income tax through the new Income Tax Portal website, be aware that you will be liable to pay convenience charges and Goods and Services Tax (GST) for using certain payment methods. For example, you may be charged Rs 300 for an income tax payment of Rs 30,000 using any of the payment modes.

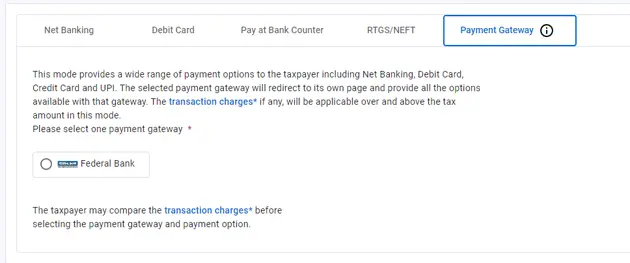

Convenience charges and GST will be applicable if income tax is paid using the 'payment gateway' on the e-filing of income tax payments website. If you pay using a "Payment Gateway" - which is one of the five payment options listed below, certain payment methods will be subject to transaction fees.

When you click on "transaction fees", the following table will appear. The table specifies the fees applicable to certain payment methods made through the payment gateway.

|

Mode of Payment |

Transaction charges |

|

Net banking |

Convenience fee HDFC Bank: Rs 12 ICICI Bank: Rs 9 SBI Bank: Rs 7 Axis Bank: Rs 7 Other banks (including Federal Bank): Rs 5 Plus, GST @ 18% |

|

Credit card |

0.85% + GST @ 18% |

|

Debit card |

NIL |

|

UPI |

NIL |

Here's an example to explain how much extra you'll pay in income tax. Suppose you have an income tax of Rs 30,000 to pay and you decide to pay it by credit card. A convenience fee of 0.85% will be charged on Rs 30,000. The amount will be Rs.255. GST will also be applicable on convenience charges (Rs 255) i.e. Rs 45.9. Thus, an individual paying income tax through credit card ends up paying Rs 30,000 + Rs 255 + Rs 45.9 = Rs 30,300.9, almost Rs 301 extra. Fees will increase in proportion to the increase in income tax paid by credit cards. However, if Income Tax is paid using the Internet Banking facility along with GST, a flat fee will be charged for the payment gateway method.Source: Income tax e-filing portal on 3.9.2022

Abhishek Soni, CEO, Tax2win.in – an ITR filing company says, “Transaction charges apply if payment gateway method is used to pay income tax on the new tax portal. The payment gateway method is applicable for paying income tax using Net banking of non-authorized banks, credit card, and UPI. However, if the income tax is paid on the NSDL website, there are no transaction charges. The NSDL website allows individuals income tax payments through an internet banking facility without any charges. Whereas, if the e-filing portal is used for income tax payments through HDFC Internet Banking, a convenience fee of Rs 12 with GST will apply.”

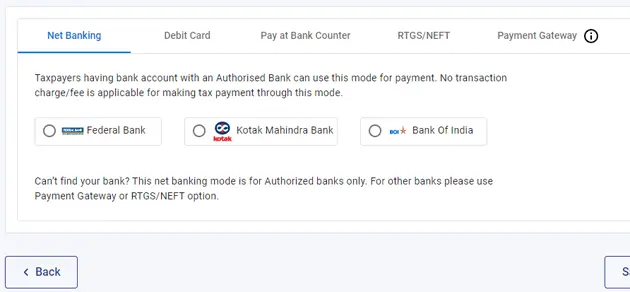

According to the income tax e-filing portal, if an individual pays taxes using the Net Banking option of authorized banks, he/she does not pay any transaction fee/fee. However, currently, there are only three authorized banks – Federal Bank, Kotak Mahindra Bank, and Bank of India. Therefore, if an individual pays income tax using the internet banking facility of these banks, no transaction fee will be charged.

Apart from internet banking, the income tax e-filing portal enables an individual to pay income tax also through NEFT, RTGS and also over the counter (physically at a bank branch). Payment by debit card is not yet allowed on the e-registry portal.

There is usually no charge for paying over the counter by check. NEFT/RTGS are applicable according to the bank. For any clarification/query on GST, feel free to contact the GST consultant at ASC Group.

Source: Economics Times

Leave a Reply

Your email address will not be published. Required fields are marked *