Virtual CFO Services

Organizations are rapidly realigning their operations considering digital advancement, to meet the new business challenges irrespective of business size and seize new growth opportunities. Managing a business’s finances, audits, internal regulations, legal compliances, capital, corporate governance, and addressing digital requirements is of utmost importance and one cannot afford to neglect any of these areas. The Founders often get misled in their vision for growth towards ensuring compliance and cashflow issues. With the market requirement for supreme mentors and coaches, Virtual CFO Services have become prevalent guiding Startups, MSMEs, and Large Enterprises and acting as an umbrella solution for managing business challenges and boosting growth.

With MSME contributing up to 31% of the GDP of India and the way the start-ups are mushrooming in India has generated a massive demand for specialized service providers. These businesses are the backbone of the economy and must have a clear business plan and financial forecast for solid business growth. The virtual CFO is one such requirement that helps and targets to meet these business requirements in a sustainable and cost-effective manner

Who is a Virtual CFO?

A Chief Financial Officer (CFO) is the senior management of a company who is responsible for the company's finances, managing financial risk, generating financial reports, strategic decision-makers, Coach/Mentoring startups, and MSMEs and he is directly accountable to an organization’s stakeholders. A virtual CFO may suggest and guide you with advanced tactics to make your company more profitable and achieve business goals.

Companies such as start-ups, Micro Small & Medium Enterprises (MSME), and small and medium-sized enterprises (SMEs), most find it difficult to hire a virtual CFO due to a lack of resources. As a result, these businesses use outsourced CFO services to improvise their performance. To make the operation smooth and affordable Virtual CFO Services helps businesses with comprehensive solutions to complex business problems.

Benefits of Hiring Virtual CFO for Start-ups and MSME Enterprises

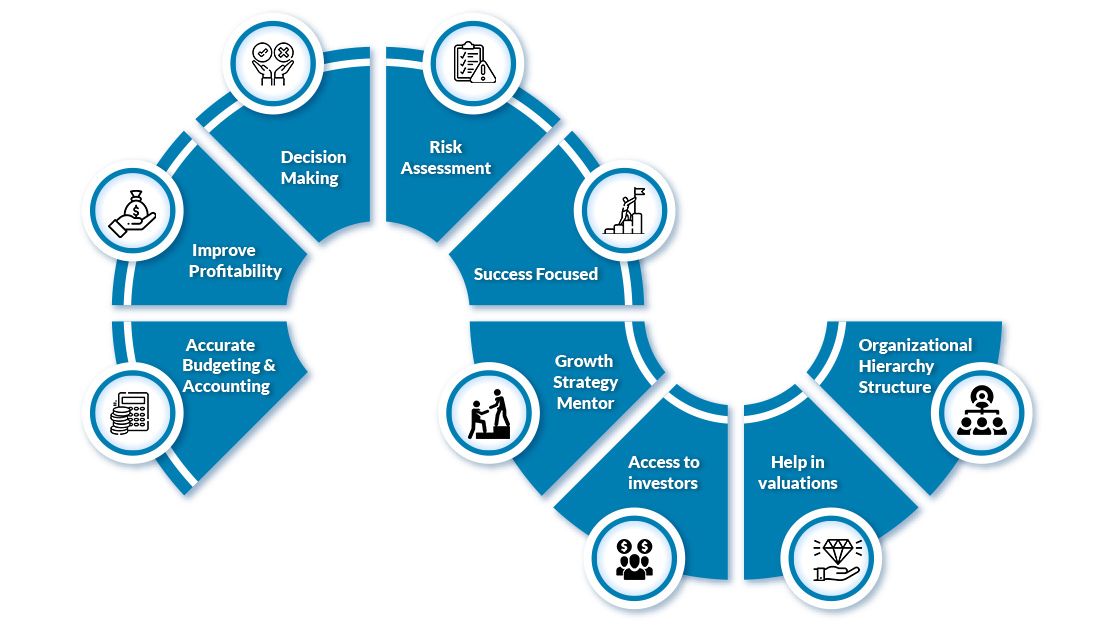

- Accurate Budgeting & Accounting: A strong and well-planned Budgeting ensures the company maintains healthy profit. Virtual CFO also assists in determining the amount of money required by combining the salary and the cost.

- Improve Profitability: Virtual CFO services analyze your resources and save your company from any sort of wastage. A well-planned and executed strategy boosts the overall productivity of the business.

- Decision Making: Virtual CFO also helps in the decision-making process of the company which ultimately leads to business growth. It analyses the finances and operations of the company by using the identification of key operational indicators.

- Risk Assessment: Virtual CFO recognizes potential risks and provides solutions to curb the level of risk which may influence business over the long haul and improve opportunities.

- Success Focused: Virtual CFO keeps a constant eye on the current market and financial condition and works continuously on a success-based model. The virtual CFO frequently tracks and evaluates factors such as production, distribution, sales, cash flow, distribution, and inventory levels which show the KPIs.

- Growth Strategy Mentor: The virtual CFO evaluates the business and suggests growth strategy/planning. The virtual CFO creates a suitable improvement plan, market strategy, and advanced idea in order to recognize when financing is required in the business.

- Access to investors: Virtual CFO also helps in the decision-making process and looking to relevant options of investors for the organization which ultimately leads to the growth of the business.

- Help in valuations: Business Valuations of Assets, Liabilities, and securities recognize the market equity value instruments, debt instruments, and derivatives issued by government agencies, financial institutions, and corporate organizations.

- Organizational Hierarchy Structure: Virtual CFO services have the power to make any changes in the organizational hierarchical structure of the company as and when needed for business growth.

When to hire a Virtual CFO?

A virtual CFO's job is more strategic and value-focused. As the business grows and needs changes, the role of the CFO becomes most relevant in the business to support the regulatory environment provide professional advice, and support business growth. The growth of Start-ups and MSMEs requires seasoned finance professionals to manage the finances.

Coupled with increased tax and regulatory compliance, requires much more detailed disclosures, industry comparisons, and improved corporate governance for the external stakeholder management. In addition, earning and budget pressures, robust reporting mechanisms to track business results, and internal team coordination challenges.

Virtual CFO will help and enable and resolve all the issues the team faces by eliminating the sources of financial w while ensuring the accounting records are robust and reliable. In addition, the outsourcing of virtual CFO services will not just limit to managing the finances; they will work as a coach to businesses and mentor HOD's helping them in decision-making, evaluating business opportunities, and providing guidance allowing promoters to focus on business growth

Virtual CFO for Start-ups

The concept of a virtual CFO is unique and advanced which is trending due to the increase in competition and advancement of digital business. It’s way more challenging for start-ups or small enterprises to stay relevant in the market without CFO support and hiring in-house is way more expensive for a small-size organization. When a start-up hires a Virtual CFO Service, it gains access to a knowledgeable and experienced CFO professional at a comparatively low cost. Most start-ups are now moving forward with Outsourced CFO Services to grow extensively in the market.

Virtual CFO for MSMEs

Micro, Small, and Medium enterprises (MSMEs) in the manufacturing and service sectors that account for a large part of the Indian economy have got a special focus. The post-COVID period is expected to be the golden era of MSME in the country. A lot of MSME businesses fail in spite of high abilities due to poor financial management, lack of industry experts or mentors, and lack of decision makers. A virtual CFO service identifies the problems of an MSME effectively by guiding them with industry-specific financial, legal, and professional advice and supporting them with the success-based model. By outsourcing all of its management responsibilities to a virtual CFO the company can focus on its primary business.

How ASC Helps in Virtual CFO Services?

ASC has a pool of professionals with rich industry experience and can help in providing virtual CFO services for start-ups and MSMEs who will work with your company. A virtual CFO can help you manage your books, create budgets and monitor your finances. ASC provides a one-stop solution to all business needs and ensures growth consistently. No matter what type of financial, legal, hierarchical, regulatory, etc.

Also, Check "SCOMET License"

How We Make an Impact?

- Flexible Cost: Keeping Fixed costs at a low level with expert CFO support for the business you can choose the amount of work the Virtual CFO would do depending on chosen services. These services can be on-site, off-site, or Hybrid

- Growth-oriented Solution: Virtual CFO helps identify risks and challenges and support for growth)

- Experienced Team: Virtual CFO services are backed up by experience resources for Mentoring, compliance with diverse work experience

- Future-ready: Setup support for inhouse Finance teams, Treasury Management, and Cashflow focus and help businesses towards digital transformation

- Accounting reforms: Helps to define and determine the reporting structure and define the right software choices for digital transformation

- Umbrella Coach: Help Coach and support () Managing high-level financial strategy, planning, decision-making, and operational optimization

- Financial Mentor: Help develop the Financial plans and reporting structures and monitor the performance on a regular basis

- Treasury and Funds Management: Manage relationships with Banks and working capital and help find investors.

- Risk Management: Profession Virtual CFO at ASC will take care of your overall financial, growth, risk, and management of your company.

- Other related Assistance: support in the management of HR & Payroll system, GST, etc.

FREQUENTLY ASKED QUESTIONS

Virtual CFO services are some of the most cost-effective services, especially considering the benefits it provides in terms of organizational growth and better financial management.

Virtual CFO services are usually provided on a remote basis from a distant place. However, if onsite services are required, then the same can be provided as well depending upon the needs and requirements.

Outsourced Virtual CFO services provide a one-stop solution for all your financial, accounting, and strategic needs. An accountant focuses on bookkeeping and accounting, payrolls, payment processing, and closing of books of accounts. A Virtual CFO provides comprehensive services from accounting to reviewing financials, budgeting, strategic support, identifying growth opportunities, etc.

Virtual CFOs also provide startup services aiding them from the preparation of reports and financials to helping them with fund raising. Nowadays, most startups are considering outsourcing Virtual CFO services as it is relatively cost-effective and they can avail of expert services in any domain.