India has been the preferred destination for overseas investors and continues to attract foreign investment across sectors for a variety of reasons. Numerous economic and administrative measures, cheap labor costs, and simplified foreign investment procedures have certainly paved the way for foreign multinationals to take an informed decision for their business growth. A business requires a proper India Entry Service Strategy and knows proper channels of India entry before it can invest in India.

Any investment by a non-resident individual or business is subject to the eligibility conditions and restrictions in the applicable foreign direct investment policy. While general permissions have been accorded to many sectors subject to the participation norms under the Automatic Route, investment after going through the government approval is also allowed, subject to certain restrictions, in other cases.

There are several routes foreign multinationals can choose to invest in India. Foreign multinationals can start their office in India and enter the Indian market to sell their goods or services through any of the following ways:

Our team of professionals has rich experience in setting up a business in India for foreign investors and multinational groups. Our range of service offerings includes an initial market study to post-setup support for operational optimization. We invest considerable time in understanding the business operations, needs, and goals of any business enterprise, and based on this offer our structured solutions.

The rank of India raised to 77 in 2018 from 100 in 2017 among 190 countries that participated in World Bank Ranking. Ease of Doing Business improved from 124.82 in 2008 until 2018, to 139 in 2010, and holding a record of high to 77 in 2018.

In recent years, the Indian startup environment has really taken off and emanated into attention on its own—motivated by factors like massive funding, evolving technology, consolidation activities, and a burgeoning domestic market. The statistics are depicting—from roughly 3000 startups in 2014 to a forecast of more than approx. 11000 by 2020, this is certainly not a passing trend. It has brought a revolution in the business and motivated young talent to start their own company by receiving great motivation from a successful startup entrepreneur. India is changing at the fastest rate and opening a gate for a global entrepreneur to establish a business in India and grow at a faster pace. We at ASC help businesses with end-to-end advisory and consulting to prepare their business for entry into India.

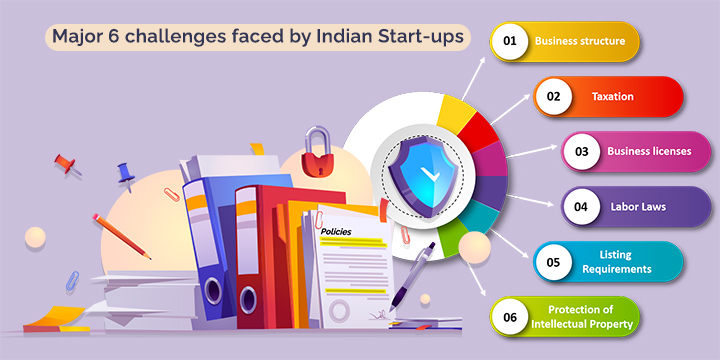

Legal Challenges are one of the biggest challenges encountered by startup companies. The startup companies might lend up into trouble when the company fails to meet all the legal requirements.

For a startup, it is not possible to pool in resources equal to the deep-rooted corporate house. However, with proper knowledge and support from the right consultancy, the risk can be prevented or diminished.

Also, Register your Company in Canada, US, European Union, Singapore, Japan with the help of ASC.

The compliance and regulations in India to start a business in India totally depends on the legal and business structure of the company. Foreign company is obligated to get approval from the MCA (Ministry of Corporate Affairs), RBI (Reserve Bank of India), and other relevant government bodies to smooth company formation in India.

India is a huge market with immense opportunity; however, it involves end number of risks and challenges that needs to be taken care. Some of the challenges business startups face are complex regulatory environment, lack of access to capital and resources, bureaucratic hurdles, cultural and language barriers, and stiff competition. To mitigate these challenges into opportunity, it is important to seek professional consultancy to stay updated with the latest market trends and government policies to accordingly plan business strategies.

India allows foreign investment in almost all the sectors, however, certain limitations on sectors like defence, telecom, and media sectors are being defined.

Foreign entities are subject to Indian tax laws & regulations to start a business in India. They need to register for GST (goods and services tax), get business PAN (permanent account number) and other applicable documentation. Foreign entities are also need to comply with transfer pricing regulations and withholding tax on certain transactions.

Foreign company planning to start business in India need to comply with labor laws and regulations such as the Employees' Provident Funds and Miscellaneous Provisions Act, Minimum Wages Act, and the Industrial Disputes Act. They need to comply the applicable labor laws and regulations in their company related to wages, safety and health, working hours, and employee benefits. They also need to consider the local employment laws and regulations compliance related to hiring and termination of employees’ policies.

Leave a Reply

Your email address will not be published. Required fields are marked *