The United Arab Emirates (UAE) issued a corporate tax law that will impose a 9% corporate tax in UAE beginning from 1st June 2023. Corporate taxes are essentially the taxes levied on profits earned by corporate entities. UAE is bringing a series of tax reforms in a bid to diversify its tax revenues and move ahead with international best practices. The UAE corporate tax will be levied on the profits earned by the corporates in UAE. Let’s decode the corporate tax law in UAE, including detailed guidelines and exemptions.

The following person will fall under the corporate tax law in UAE:

The law has exempted certain persons from the levy of UAE corporate tax. These include the following:

Further, the following incomes shall be exempt from corporate tax in UAE:

Further, there will be no withholding taxes in UAE on domestic and cross-border payments.

Following is the corporate tax rate applicable in UAE:

|

Income Criteria |

Tax Rate |

|

Taxable income does not exceed AED 375,000 |

0% |

|

Taxable income exceeds AED 375,000 |

9% |

|

Income Criteria |

Tax Rate |

|

Qualifying income |

0% |

|

Taxable income not meeting the definition of qualifying income |

9% |

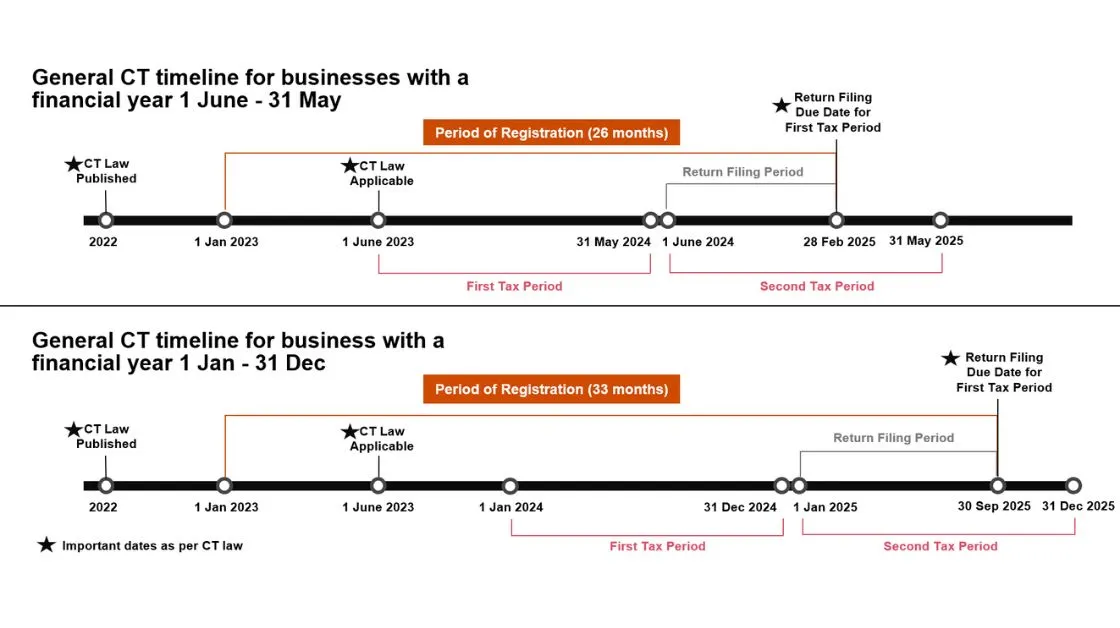

The UAE corporate taxes will be charged on the income earned for the financial year beginning on or after 1st June 2023. All taxable persons, including the free zone persons, shall be required to obtain a Corporate Tax Registration Number in UAE. Such taxable persons shall be required to pay the corporate tax and file a corporate tax return for each tax period within 9 months from the end of the relevant period. However, things will be slightly different for corporates with the financial year from 1st January to 31st December. Let’s have a comparative analysis for both financial years:

|

Particulars |

Financial Year: 1st June 20xx to 31st May 20xx |

Financial Year: 1st January 20xx to 31st December 20xx |

|

Period of registration available |

26 months 1st Jan 2023 – 28th Feb 2025 |

33 months 1st Jan 2023 – 30th Sept 2025 |

|

First Tax Period |

1st June 2023 – 31st May 2024 |

1st Jan 2024 – 31st Dec 2024 |

|

Return filing due date for the first tax period |

28th Feb 2025 |

30th Sept 2025 |

|

Second Tax Period |

1st June 2024 – 31st May 2025 |

1st Jan 2025 – 31st Dec 2025 |

Following are some of the important provisions for UAE corporate taxation:

If you have any permanent establishment in UAE or have incorporated a company in UAE, then you are most likely to fall under the UAE corporate tax. In such case, you need to ask the following questions:

It would be wiser to contact tax professionals with relevant knowledge and expertise in international taxation matters. They can help guide you through the new UAE corporate tax regime. If you want any assistance regarding UAE corporate tax law, feel free to contact the ASC Group.

References 1, References 2, References 3, References 4

Leave a Reply

Your email address will not be published. Required fields are marked *