Recent Updations in GST Portal and GST Laws

This is in regard to the recent updation that have been made by CBIC in regards to the e-invoice applicability, and some functionality in the GSTN Portal, which are listed as under:

A. E-Invoice

Vide Notification No. 17/2022 – Central Tax, dated 01.08.2022, the Central Government has made it mandatory for a taxable person whose aggregate turnover in a financial year exceeds Ten crore rupees to raise E-Invoice w.e.f. 1st October 2022.

Furthermore, the current applicability of the aforementioned is on the taxable person whose aggregate turnover in a financial year exceeds Twenty crores.

B. Changes in the GST Portal

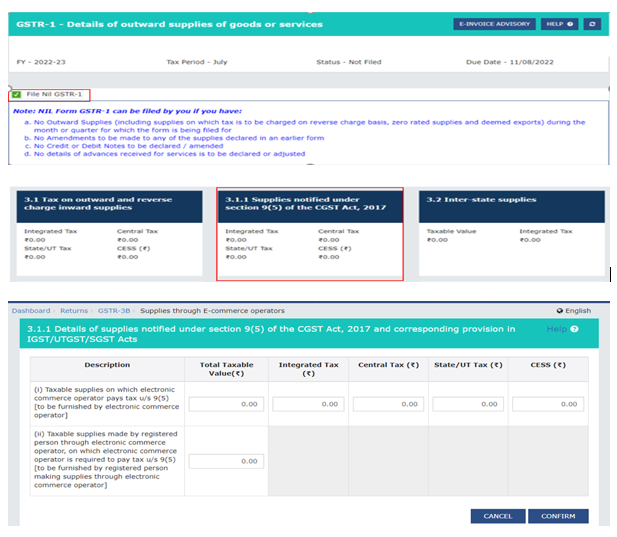

1. The Goods and Services Tax Network (“GSTN”) has introduced an option to file NIL GSTR-1 by selecting the check box without going through the process of generating a summary;

2. The Goods and Services Tax Network (“GSTN”) has made live a new Table 3.1.1 in GSTR-3B for reporting supplies notified u/s 9(5) (Taxable supplies on which ECO is required to pay Tax) of the Central Goods and Services Tax Act, 2017.

C. E-Commerce Operator

Vide Notification No. 14/2022-Central Tax, dated 05.07.2022, as per Section 9(5) of CGST Act, Electronic Commerce Operator (ECO) is required to pay tax on supply of services such as Passenger Transport Service, Accommodation services, Housekeeping Services & Restaurant Services if such services are supplied through ECO.

In case of any query related to GST E-invoicing, GST Portal or E-commerce operator, feel free to contact the ASC Group for professional assistance.

Notification Source:

https://www.cbic.gov.in/resources//htdocs-cbec/gst/17_2022_CT_Eng.pdf

https://www.cbic.gov.in/resources//htdocs-cbec/gst/14_2022_CT_Eng.pdf

Leave a Reply